Secure Your Future with Instant Insurance

Get instant policies for Two-Wheeler, Four-Wheeler, and Health with zero paperwork. Join India's most trusted portal for maximum commissions.

Get instant policies for Two-Wheeler, Four-Wheeler, and Health with zero paperwork. Join India's most trusted portal for maximum commissions.

Happy Retailers

Insurance Partners

Policy Issuance

Claim Support

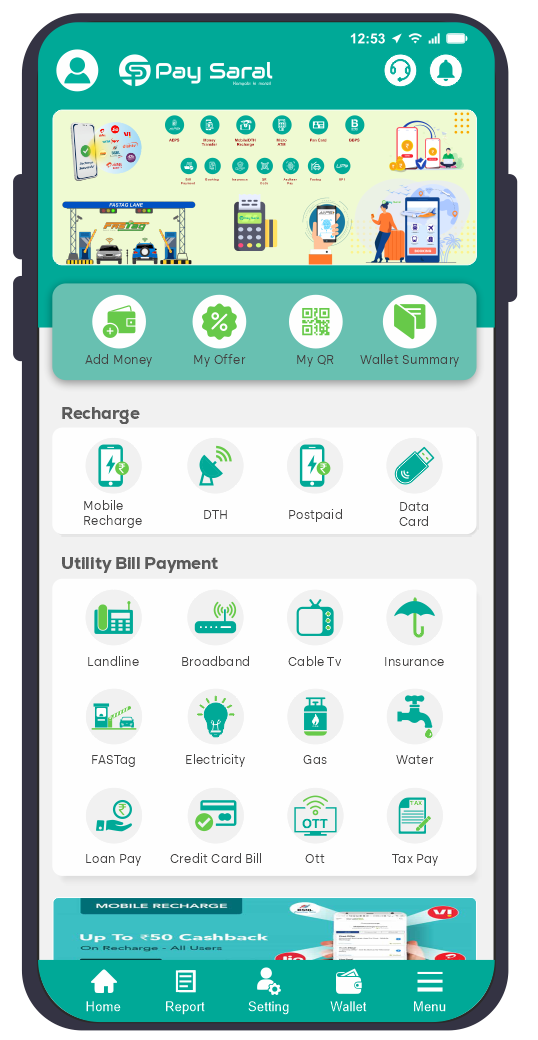

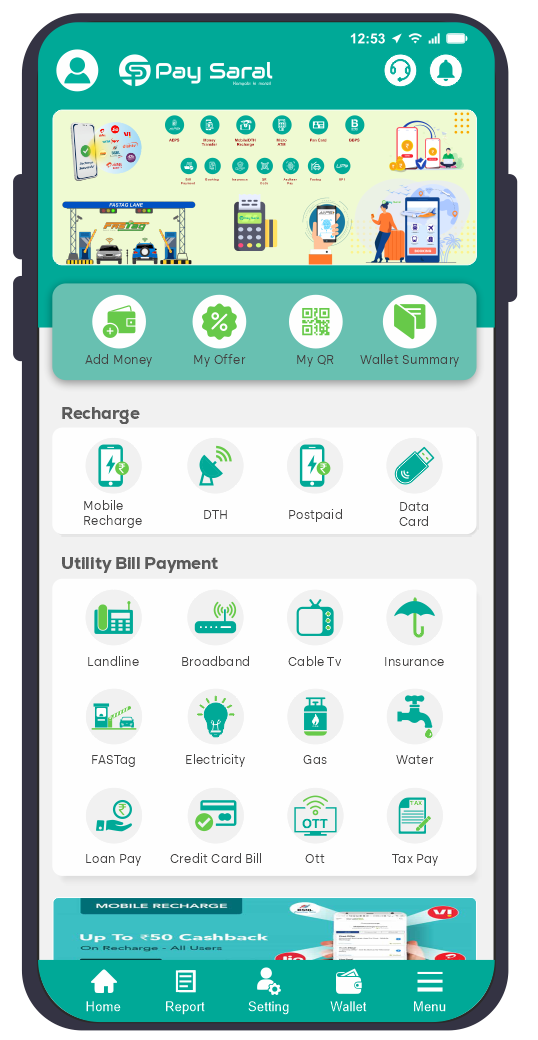

Buying insurance on PaySaral is faster than making a cup of tea!

Simply enter the vehicle number or customer details to fetch the best insurance quotes instantly.

Compare premium rates and features from India's top-rated insurance providers and pick the best one.

Make a secure payment and get your digital policy document immediately on your WhatsApp and Email.

Comprehensive two-wheeler insurance is a critical financial tool designed to protect bike and scooter owners against the diverse risks present on Indian roads. Beyond fulfilling the mandatory legal requirement of third-party liability, this coverage acts as an all-encompassing shield for your vehicle. The Paysaral platform provides robust protection for Own Damage, which includes losses incurred due to road accidents, fire, or lightning. Furthermore, it safeguards you against man-made disasters such as theft, burglary, and riots, as well as natural calamities like floods and earthquakes. Our retail partners can offer instant digital policy issuance with zero physical inspection, allowing customers to receive valid insurance documents in under two minutes.

Covers damages from accidents, theft, fire, and natural disasters in one plan.

Get full claim amount for replaced parts without any deduction for aging.

Renew even long-expired policies instantly without physical vehicle inspection.

Protecting your car with a premium insurance plan is essential for maintaining its value and ensuring your family's safety during travel. At Paysaral, we provide advanced car insurance solutions that offer massive savings of up to 75% on own-damage premiums while delivering superior coverage. Our plans include high-end protections like Engine Secure, Return to Invoice, and 24x7 Roadside Assistance. Whether you drive a luxury sedan or a compact hatchback, our network of over 5,000 cashless garages across India ensures that you receive high-quality repairs with zero out-of-pocket expenses. Our digital comparison tool allows retailers to find the best quotes from top insurers instantly, providing a transparent and stress-free insurance experience.

Protection against costly engine repairs due to waterlogging or oil leakage.

Emergency towing, flat tire changes, and fuel delivery at any location.

Get the full original on-road price if your car is stolen or totally damaged.

In an era of skyrocketing medical inflation, a comprehensive health insurance policy is essential to protect your life savings. Paysaral health plans provide a complete financial shield for you and your family against expensive hospital treatments. Our coverage includes a wide range of benefits such as in-patient hospitalization charges, ICU fees, and advanced modern medical procedures. We offer a unique cashless facility at over 10,000 network hospitals nationwide, ensuring that medical care is prioritized over payment during emergencies. Additionally, these plans cover pre and post-hospitalization costs, making it a dual-benefit tool for health and wealth protection for every household.

Direct payment to 10,000+ network hospitals for worry-free medical treatment.

Save up to ₹75,000 on income tax annually on premiums paid for your family.

Renew your health cover for life regardless of any future medical conditions.

Life insurance is the cornerstone of a responsible financial plan, serving as a promise of long-term security for your loved ones. Paysaral provides a variety of products ranging from high-cover Term Insurance to wealth-building investment plans. A term policy ensures that your family can maintain their current lifestyle and fund major life goals even in your absence. Our life insurance solutions are designed with high claim-settlement ratios and offer a completely paperless onboarding process. With Paysaral, we provide a 360-degree safety net that guarantees your family's financial independence and peace of mind for years to come.

Get massive life coverage for your family at very nominal and affordable premiums.

Get guaranteed returns or investment-linked growth upon policy maturity.

Additional financial payout on diagnosis of specified life-threatening diseases.

Go beyond recharge. Offer Money Transfer, Bill Payments, and more.

No waiting! Get your insurance document on WhatsApp & Email in 2 minutes.

We only work with IRDAI-approved top insurance companies in India.

Stuck with a claim? Our dedicated experts are just one call away 24/7.

Lowest premium guaranteed. Save up to 75% on your existing policies.

Everything you need to know about PaySaral Insurance Services

Join thousands of Paysaral retailers and provide the best insurance services to your customers.

Limited slots available for today. Activate your account now.